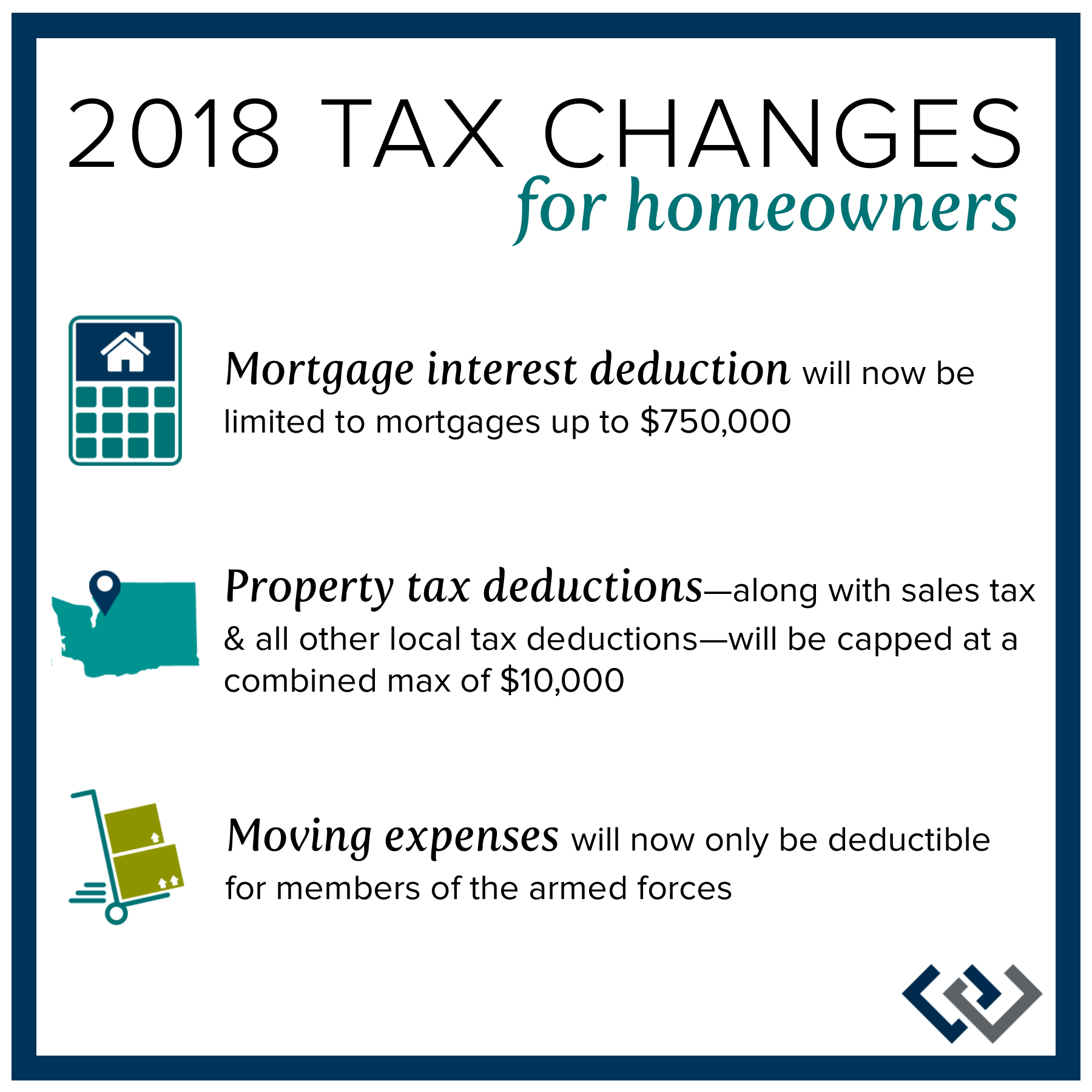

Now that the 2017 tax deadline has come and gone it is time to think about how the new tax reform of 2018 might affect you next year. A few notable items are the limited mortgage interest rate deduction capped at $750,000, limited property tax deduction capped at $10,000 and moving expenses can only be written off by members of the armed services. Read the full article here and take notes, so you are prepared for next year’s tax season.

Social Links Widget

Click here to edit the Social Media Links settings. This text will not be visible on the front end.

Uncategorized •

May 15, 2018

How Does the New Tax Reform Affect You?

by Melissa Huddleston

Related Articles

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link