On April 9th, our office had our annual Shred Event and Food Drive. In 4 hours, we filled two shredding trucks and helped hundreds of clients carefully destroy documents and do some spring cleaning. We bill this event as one of our annual food drives and we are happy to report that our clients were beyond generous! We raised $2,650 and collected 1,993 pounds of food! We partner with the Volunteers of America of Snohomish County who manages the county food bank coalition and gets the food and money spread throughout the region.

High Equity & Looking to make a move?

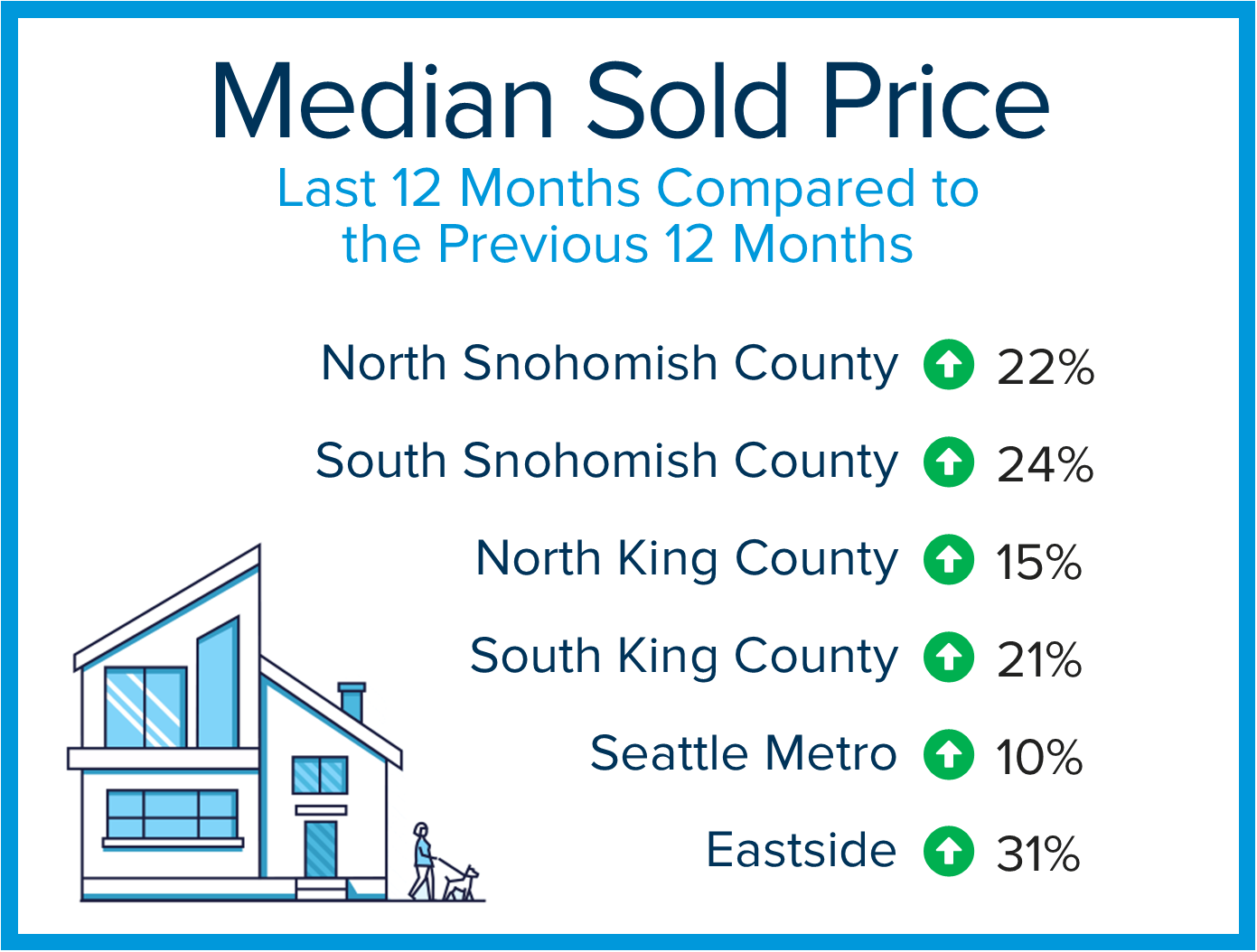

Did you know that over 50% of homeowners in Washington State have over 50% home equity? We have had 10 years of price appreciation, and the last 3 years have been record-breaking. The chart below shows complete year-over-year (the last 12 months over the previous 12 months) price appreciation for the six main market areas in the Greater Seattle area. Home equity gains have been plentiful!

What does this mean when you go to sell? You need to consider capital gains taxes when estimating your total profit. This is important as we typically move our profit into our next home, making this a critical element in planning our future. You can qualify for a tax exclusion: $250,000 for a single person and $500,000 for a couple as long as you meet certain requirements.

What does this mean when you go to sell? You need to consider capital gains taxes when estimating your total profit. This is important as we typically move our profit into our next home, making this a critical element in planning our future. You can qualify for a tax exclusion: $250,000 for a single person and $500,000 for a couple as long as you meet certain requirements.

- You must have owned the house for at least two years. Check out this IRS link for more details.

- And you must have lived in the house as your primary residence for two out of the last five years, ending on the date of the sale.

The two years do not need to be consecutive as long as you’ve lived in your home for a total of 24 months out of the five years prior to the sale. You can also only claim the exclusion every two years. This is important for folks who own multiple homes and are looking to liquidate. This would need to be strategically spaced and would require living in each home for the designated amount of time.

Another important element for calculating the tax implication is understanding your cost basis. The cost basis is a combination of the purchase price, certain legal fees, improvement costs, and more. It is important to have good record-keeping on all capital improvements you’ve made to your home to increase your cost basis which will in turn decrease your taxable profit. Capital improvements increase the value of your property versus a repair which only restores the property to its original condition. This informative Charles Schwab article provides a sample tax bill that outlines how capital improvement can help offset your tax burden.

Of course, consulting your trusted CPA on your tax implications is a valuable resource. It is my hope that this overview of the requirements and how you would go about a calculation helps you understand how to prepare for your next move if you are in an equity position that would incur capital gains. It is always my goal to help keep my clients informed and empower strong decisions.

North King County Quarterly Report

The 2022 real estate market started with a bang! We started the year with the lowest amount of available inventory we’ve ever seen coupled with interest rates a point lower than they are now, along with a plentiful buyer pool due to a strong job market and work-from-home influenced moves. The combination of supply and demand and low debt service created an intense seller-centric environment which resulted in huge home price increases from January to March. This is on top of ten years of solid price growth; over 50% of homeowners in WA state have at least 50% home equity.

As we head into the spring and summer months, we anticipate seasonal increases in inventory, which will provide much-needed selection for buyers. Interest rates have increased as a tool to combat inflation, which was predicted by experts across the nation and announced by the Fed. Rates still remain historically low and have only departed from the “tell-your-grandkids” levels between 3.5% to 4.5%. Price growth should start to temper after a feverish Q1 and buyers will enjoy more selection. If you are curious about how your real estate goals match up with the market, please reach out. It is my goal to help keep my clients informed and empower strong decisions.

South Snohomish County Quarterly Market Report

The 2022 real estate market started with a bang! We started the year with the lowest amount of available inventory we’ve ever seen coupled with interest rates a point lower than they are now, along with a plentiful buyer pool due to a strong job market and work-from-home influenced moves. The combination of supply and demand and low debt service created an intense seller-centric environment which resulted in huge home price increases from January to March. This is on top of ten years of solid price growth; over 50% of homeowners in WA state have at least 50% home equity.

As we head into the spring and summer months, we anticipate seasonal increases in inventory, which will provide much-needed selection for buyers. Interest rates have increased as a tool to combat inflation, which was predicted by experts across the nation and announced by the Fed. Rates still remain historically low and have only departed from the “tell-your-grandkids” levels between 3.5% to 4.5%. Price growth should start to temper after a feverish Q1 and buyers will enjoy more selection. If you are curious about how your real estate goals match up with the market, please reach out. It is my goal to help keep my clients informed and empower strong decisions.

Spring Market in Bloom

As we round out the first quarter of 2022 and head into the notorious Spring Market there are a handful of factors that should be considered whether you are a buyer or a seller. Paying attention to the anticipated increase in housing supply, monitoring buyer demand, and assessing the effects of rising interest rates on the market, are current influencers but also have some historical merit. How will these factors affect home prices, buyer opportunities, and overall market conditions? It is important that as we look forward, we also look back, as keeping a well-researched, educated perspective will lead to success.

HOUSING INVENTORY IN BLOOM

April through July historically have the most homes coming to market during a given year. We are sitting at the starting line of selection! Buyers who have been battling through the first quarter (Q1) and find themselves discouraged need to stay calm and carry on into these listing-heavy months. The increase in supply will provide opportunities to win a house as more selection will decrease the number of offers on each house. We are already starting to see the double-digit multiple offers temper to 3-6 offers and sometimes even just one, as the number of listings has grown month-over-month since January.

This increase in supply will also start to moderate price escalations. There were very large price escalations in Q1; the average list-to-sale price ratio in February 2022 in Snohomish County was 10% and 11% in King. Many new listings will come to market this spring on the shoulders of those price gains which will reduce the escalation amounts. We like to call this stair-stepping up the list price based on recent sales. We still anticipate price appreciation but expect the month-over-month growth to decelerate off of these high peaks in Q1. This will create some ease for buyers who stay engaged with their home search.

BUDDING BUYER DEMAND CONTINUES TO OUTPACE SUPPLY

As we track pending sales through March, they continue to track with or outpace new supply depending on which area. This is an indicator that there will continue to be buyer demand to sustain the increase in new listings that are coming this spring. Many buyers are still positioning their pandemic-influenced housing needs and making moves due to work-from-home options. In addition, there is a large population of Baby Boomers transitioning to their right-size homes and a wave of Millennials are poised to make their entrance into homeownership. Buyer demand will be met with more selection over the coming months.

Speaking of first-time buyers, it is extremely important that they understand that besides the lifestyle decision of owning a home, they are making an important investment. Real estate is one of the strongest, if not the strongest wealth-building assets available. Paying towards your own asset vs. your landlord’s will help build net worth as your home appreciates. As a first-time buyer, it is as much about securing the wealth-building asset as it is about choosing an ideal place to live. Buyers always need to make concessions on either price, location, or features, but in the end, will end up with an appreciating asset that will start to build their financial future.

Speaking of first-time buyers, it is extremely important that they understand that besides the lifestyle decision of owning a home, they are making an important investment. Real estate is one of the strongest, if not the strongest wealth-building assets available. Paying towards your own asset vs. your landlord’s will help build net worth as your home appreciates. As a first-time buyer, it is as much about securing the wealth-building asset as it is about choosing an ideal place to live. Buyers always need to make concessions on either price, location, or features, but in the end, will end up with an appreciating asset that will start to build their financial future.

GROWING INTEREST RATES

Interest rates have taken a ride up over the last month as the first increase by the Fed was made to help combat inflation. An increase in interest rates has been predicted for some time, and it is finally happening after several years at all-time historic lows. It will be critical that buyers monitor the rates closely to make sure they relate the monthly payment to the price they are able to and willing to pay. Also, buyers can get creative with their lender and choose to buy down their rate in order to secure a lower rate, hence a lower monthly payment. Aligning with a skilled lender to help navigate the changing environment will be critical.

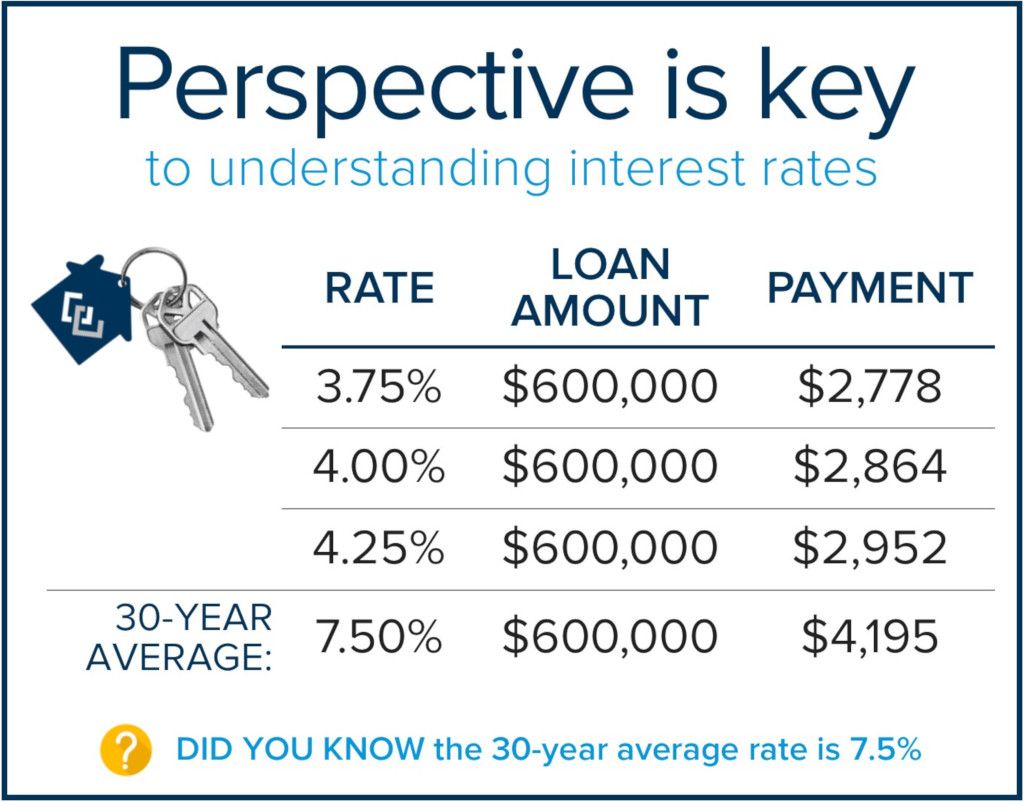

It is also important for  consumers to understand that rates are still well below the 30-year average of 7.5%. This perspective is key, along with understanding that rates are probably not to their 2022 peak yet according to the experts. Acting sooner rather than later will help secure a lower debt service for your long-term investment. While the “tell-your-grandkids” rates of 2.75-4% may be gone, there is still an amazing story to tell where we sit now!

consumers to understand that rates are still well below the 30-year average of 7.5%. This perspective is key, along with understanding that rates are probably not to their 2022 peak yet according to the experts. Acting sooner rather than later will help secure a lower debt service for your long-term investment. While the “tell-your-grandkids” rates of 2.75-4% may be gone, there is still an amazing story to tell where we sit now!

WHAT DOES THIS ALL MEAN FOR PRICES?

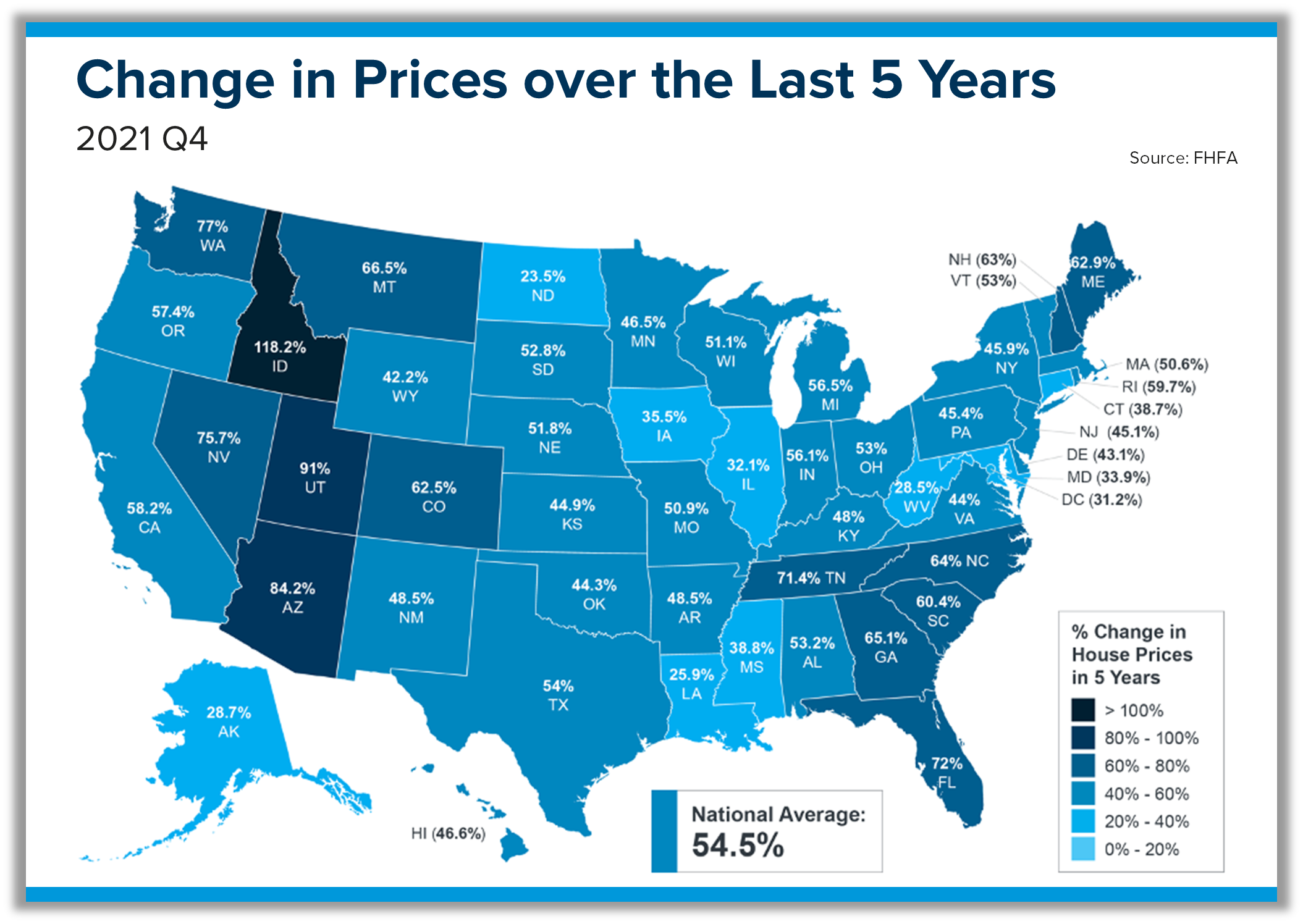

Seasonal increases in selection will start to temper the month-over-month increases in prices and higher rates may put downward pressure on price growth, but homeowners are still sitting on top of a heap of price appreciation. Price appreciation over the last 5 years has been formidable across our nation.

In Snohomish County, prices are up 23% complete year-over-year and up 73% from 5 years ago. In King County, prices are up 15% complete year-over-year and up 54% from 5 years ago. Historical average price appreciation is closer to 3-5% annually, so taking into account gains over the last handful of years is important to have a balanced perspective. The bottom line is sellers are equity rich and have advantageous options to make moves!

If you have been considering a move and are curious about the value of your home in today’s market, please reach out. I would be happy to assess your home’s value and help you start to formulate a plan. If you have been beaten up as a buyer in Q1, I urge you to stay in the game, you are at the cusp of opportunity. Buyers and sellers need each other now, more than ever. There will be more flexibility in the market with more selection. The inventory environment we have been in has been so intense. We are ready for the intensity to ease and for the market to be a bit more fluid.

All indicators point toward another positive year in real estate as we enter the spring market. It is always my goal to help keep my clients informed and empower strong decisions. Please reach out if I can help you or someone you know navigate their real estate goals.

You’re invited to our annual Paper Shredding Event & Food Drive. We partner with Confidential Data Disposal to provide a safe, eco-friendly way to reduce your paper trail and help prevent identity theft.

Saturday, April 9th, 10AM to 2PM*

4211 Alderwood Mall Blvd, Lynnwood

Bring your sensitive documents to be professionally destroyed on-site. Limit 10 file boxes per visitor.

This is a paper-only event. No x-rays, electronics, recyclables, or any other materials.

We will also be collecting non-perishable food and cash donations to benefit Volunteers of America Western Washington food banks. Donations are not required, but are appreciated. Hope to see you there!

*Or until the trucks are full

You’re invited to our annual Paper Shredding Event & Food Drive!

You’re invited to our annual Paper Shredding Event & Food Drive. We partner with Confidential Data Disposal to provide a safe, eco-friendly way to reduce your paper trail and help prevent identity theft.

Saturday, April 9th, 10AM to 2PM*

4211 Alderwood Mall Blvd, Lynnwood

Bring your sensitive documents to be professionally destroyed on-site. Limit 10 file boxes per visitor.

This is a paper-only event. No x-rays, electronics, recyclables, or any other materials.

We will also be collecting non-perishable food and cash donations to benefit Volunteers of America Western Washington food banks. Donations are not required, but are appreciated. Hope to see you there!

*Or until the trucks are full

Global influences on the housing market & interest rates.

A lot has happened in our world since the first of the year, specifically the rise in inflation and the recent Russian invasion of Ukraine. These factors can influence consumers and affect the housing and financial markets. Additionally, global unrest has had a clear influence on interest rates, driving them back down after a 1-point increase since November 2021.

Please listen to the latest video update from Windermere’s Chief Economist, Matthew Gardner (link below) that was released this Monday, 3/7/22. He provides updated insights and projections for the housing market and interest rates for 2022 and beyond, some of which have been adjusted since his January forecast.

It is always my goal to help keep my clients informed and empower strong decisions. At Windermere, we are so fortunate to have Matthew in our corner providing such expertise to help us help our clients strategically navigate the environment. Please reach out if you have any questions or if you would like to discuss how your goals relate to the market.

As Matthew stated in the video above, it is important that we keep interest rates in perspective. The chart below illustrates where rates are hovering today and where he and other experts expect to see them by the end of the year and how that affects monthly mortgage payments (principal & interest only).

We also have included the 30-year average rate to show the historical significance of today’s low rates. Even though rates have come up 1 point since the absolute bottom level in January 2021, they are still much lower than the historical average, and they are helping to offset affordability challenges.

However, at some point, rates could reach 5% which could put downward pressure on prices like the last time rates reached that level in the latter part of 2018. It is all about how the monthly payment pans out based on the rate. The variable effect of rates on prices will find its balance based on buyer appetites for monthly payment amounts.

Cheers to 50 Years!

Cheers to 50 Years!

Fifty years of relationships, 50 years of giving back to our communities, and 50 years of growth. In 1972, Windermere Real Estate was founded by John Jacobi in the Sand Point neighborhood of Seattle, WA. Since then, Windermere has expanded to 10 states including Washington, Idaho, Oregon, Montana, California, Arizona, Nevada, Utah, Hawaii, and Colorado. Our network reaches over 300+ offices and 7,000+ brokers. I can tap into our network of offices in the states above and I can also access Leading Real Estate Companies of the World beyond our Windermere network to help you find a like-minded broker for your out-of-area needs.

Even better, Windermere has donated just over $46 Million through the Windermere Foundation, giving funds back to the communities in which we serve. Windermere’s collective goal in 2022, is to get the Windermere Foundation to the $50 Million mark to help commemorate this monumental anniversary. Here’s to another impactful 50 years serving our communities through relationships, homeownership, and community outreach.

has donated just over $46 Million through the Windermere Foundation, giving funds back to the communities in which we serve. Windermere’s collective goal in 2022, is to get the Windermere Foundation to the $50 Million mark to help commemorate this monumental anniversary. Here’s to another impactful 50 years serving our communities through relationships, homeownership, and community outreach.

Seller Equity is at an all-time high

2022 has had an incredibly eventful start in our local real estate market. In January, the average list-to-sale price ratio (the percentage a house sells for in comparison to the list price) in King County was 105% and in Snohomish County it

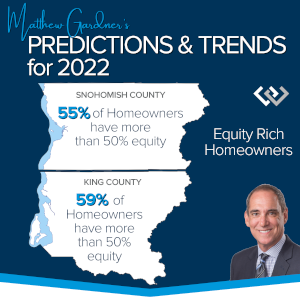

2022 has had an incredibly eventful start in our local real estate market. In January, the average list-to-sale price ratio (the percentage a house sells for in comparison to the list price) in King County was 105% and in Snohomish County it was 106%. This is in conjunction with complete year-over-year median price appreciation (the last 12 months of price growth averaged and compared to the previous 12 months of price growth) of 15% in King County and 23% in Snohomish County. In fact, 59% of homeowners in King County have more than 50% home equity and 55% of homeowners in Snohomish County have over 50% home equity.

was 106%. This is in conjunction with complete year-over-year median price appreciation (the last 12 months of price growth averaged and compared to the previous 12 months of price growth) of 15% in King County and 23% in Snohomish County. In fact, 59% of homeowners in King County have more than 50% home equity and 55% of homeowners in Snohomish County have over 50% home equity.

With that said, how does one navigate successfully transitioning that equity to their next move, and who do they choose to help them with the job? With inventory at an all-time low and interest rates still hovering around 4%, buyer demand is high. There is no denying that homes sell quickly in this environment and oftentimes for over list price due to multiple offers. There are many different business models available to consumers when selecting who they align with to help them make this very important move. There are brokerages that will offer an up-front rebate on the commission and there are full-service brokerages, with a lot in between.

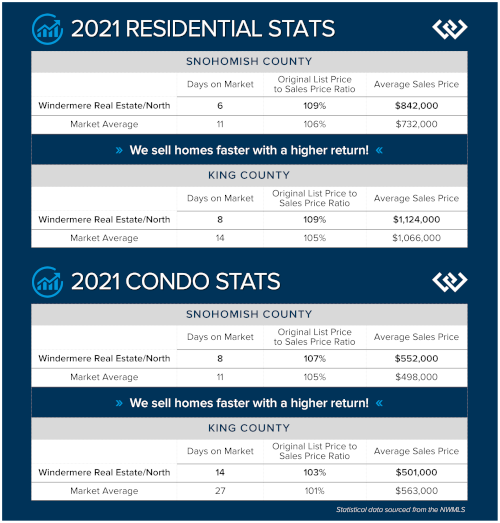

Before I highlight what a full-service brokerage, like Windermere North, has to offer a seller I want to show you some numbers rooted in seller results. In 2021, my office, Windermere North, outperformed the market – we sold homes faster and at a higher return!

Even as we track our statistics so far in 2022, according to NWMLS data, my office’s average list-to-sale price ratio for King and Snohomish Counties combined, including both residential and condo sales, was 114% and 4 days on the market. This compares to the average market results of 105% and 19 days on the market.

Our approach involves a strategic home preparation process, detailed price analysis, and keen negotiations. You might ask what type of negotiations happen when a seller is reviewing a stack of offers; actually, more than you know. Sifting through the terms of offers and vetting the buyers through rapport-building with their broker and lender helps us unearth who the most qualified buyer is to get into contract with. This takes extra time and skilled communication, but as you can see, these extra steps pay off for our sellers.

We also understand that getting a home ready for market can be a daunting task, but the upside is too measurable to ignore. We help our clients identify a punch-list of prep items and match them up with concierge-level service providers to help complete the work. Even if our sellers are limited in funds to prep their home, we have funds available for no up-front costs. Please reach out if you think this would be helpful.

Then the merchandising comes in (depending on the house): staging, professional photography, video, floorplans, print materials, and public exposure is planned and executed. Our listings hit the market perfectly positioned for buyers to see themselves living there and we invest in this on behalf of our sellers. We help connect the emotional dots that invoke buyers’ lifestyle goals resulting in high returns for our sellers.

Lastly, perspective is key! Markets shift, ebbing and flowing. Pricing a home is strategic and requires analysis of the recent sales, historical seasonality, and current market trends. This research is done sifting through data, but also with intangible outreach to fellow brokers inquiring about their experiences and gleaning conclusions. Also, physically touring the inventory, whether I’m showing buyers or walking through to see for myself, helps me understand how a home measures up and what buyers are looking for. All of these steps are over-and-above the norm and help contribute to the results my office is producing.

If you are considering a move, make sure you align yourself with a trusted advisor who is willing to put in the extra work to get you the best possible results. Navigating an extreme sellers’ market takes great skill and care to garner the best results. If done right, that skill and care will beat out any upfront discount a less-engaged broker will offer to win a listing. Make sure you consider the big picture, not just an immediate reward. Understand that who you choose to partner with to assist you with one of the biggest financial decisions a person ever makes is a very big deal. It is always my goal to help keep my clients well-informed and empower strong decisions. Please reach out if you think I can help you or someone you know, whether you are just curious about the market or you’re ready to make a move.

2022 Predictions

Last week, my office hosted our 14th annual Economic Forecast Event with Matthew Gardner, Windermere’s Chief Economist. It was an hour-long presentation followed by lively Q & A that was packed with useful information to help guide us as we start the new year. Matthew journeyed the audience through a macro to micro approach, reflecting on all of the activity in 2021 and also analyzing future trends.

He started with a national overview of the economy overall and ended with a detailed accounting for King and Snohomish County housing markets, including some predictions. Below are some highlighted bullet points. Please reach out if you would like a digital copy of his PowerPoint and/or the link to the recording of his presentation.

National Economy:

The GDP (Gross Domestic Product) growth in 2021 was 3.9%, well above the long-term average of 2%. This indicates we are not in a recession and have recovered from the brief recession we experienced in the spring of 2020. A recession is defined by two consecutive quarters with declining GDP.

Matthew anticipates the U.S. to be back to full employment by the end 2022 after the fall-out of 2020 due to the pandemic shut-down.

Inflation:

Inflation peaked in Q4 of 2021 and is projected to start to slow as supply chain issues improve. Certain industries such as used cars which are costing 25% more since February 2020 are having a huge influence on overall numbers. Food and energy prices are also volatile and affecting overall numbers.

U.S. Housing Market:

Improved supply chain and labor forces will increase the number of new builds, increasing inventory to help quench buyer demand. This will slow national year-over-year price growth to 6.5% in 2022.

Regional Economy:

Jobs are increasing and will recover from the spring 2020 fall-out twice as fast as the job losses we saw during the Great Recession of 2008. In fact, he expects local jobs to fully return by the end of 2022!

Our diverse economy which includes tech, aerospace, biotech, and manufacturing will help our overall economy thrive as we are not dependent on just one industry for a full recovery.

Mortgage Rates:

Mortgage rates are predicted to slowly rise in 2022. Matthew along with the National Mortgage Brokers Association, Fannie Mae, and the National Association of Realtors expect rates to end the year just under 4%. This is well below the long-term average of 7.5%!

Prices:

In 2021, prices were up 14% year-over-year in King County and 24% in Snohomish County. He predicts housing prices to rise 13% in King County and 14% in Snohomish County in 2022. This is well above the long-term average of 5.5% year-over-year!

The Work from Home phenomenon has had a huge influence on price growth in the suburbs. Many buyers have eliminated long commutes or are only having to drive into work a handful of days a month. This has driven many buyers to consider the suburban markets which is why the price growth in Snohomish County was much higher than King. Seattle saw a bit of a correction as this new lifestyle shift came to be. He anticipates 2022 to be kind to urban markets and a continued attraction to the suburbs.

In 2021, net in-migration in both King and Snohomish Counties was up, which is continuing to have a strong influence on buyer demand. In fact, new listings were up in 2021 over 2020; it was increased buyer demand that whittled down inventory levels and drove prices up.

Homeowner Equity:

Prices have been growing since 2012 and have had historic growth over the last two years. In King County, 59% of homeowners have 50% or more equity in their homes and in Snohomish County, 55% of homeowners have 50% or more home equity.

This uptick in home equity and the Work from Home shift has reduced the average tenure a homeowner spends living in their home to just shy of 7 years in 2021 from 10 years just two years ago. This is another indicator of buyer demand.

Are we Headed Towards a Housing Bubble?

Simply put, no! Even with forbearance being a viable option to weather the fall-out from the pandemic, there will not be a wave of foreclosures on the horizon. Homeowners have too much equity to walk away, they will sell and take their profits in order to recover if need be.

Prices have made a big run, but if you take interest rates and inflation into consideration, monthly payments are only up 26% since 2000 in King County and 34% in Snohomish County. That is parallel to raw home prices being up 249% since 2000 in King County and 272% in Snohomish County.

Financial indicators such as recovering jobs, deep homeowner equity, stringent lending practices, strong buyer demand, and low interest rates combat any inkling of a housing bubble. There are 600k Millennials in King County and 171k in Snohomish County that are coming of age and will want to buy a house.

Condominiums:

Condo sales stalled when the pandemic hit as people decided if they wanted to live in such density, and the downtown core suffered due to the shutdown. Since then, the stall started to move forward and condo prices are up 7% year-over-year in King County and 23% in Snohomish County. Condos provide a more affordable option, especially for first-time buyers, and single-level, maintenance-free living for retirees. Condos are predicted to appreciate 4% in King County in 2022 and 7% in Snohomish County.

Luxury Market:

2021 was the year that the $1M home sale price became more common. In 2021 there we 11k sales over $1M in King County compared to 7k in 2020. In Snohomish County, there were just shy of 2k sales over $1M in compared to 590 in 2020. The $1M price point may not be synonymous with the definition of luxury any longer. It is more so a depiction of affordability in our region. With that said, homes in the very high-end have had brisk movement and marked appreciation.

Overview:

The Work from Home lifestyle is real and has created lots of movement in the marketplace, especially towards the suburbs. This has caused an upward trajectory on price appreciation along with continued low interest rates. New listings outpaced 2020, but buyer demand gobbled up the inventory leaving us at the lowest levels we have ever seen as we start 2022. Price appreciation will continue but is predicted to decelerate after record-breaking levels in 2021. Interest rates will creep up by the end of 2022 and inflation will improve as the supply chain recovers. Homeowner equity is at an all-time high and jobs are recovering, offsetting any big crash to the housing market. Affordability is our biggest roadblock as the landscape of the PNW has changed with tech jobs the heart of our renewed economy.

If you attended our Virtual Economic Forecast Event last week with Matthew Gardner, did you see the mountain of socks?! Matthew is a bit of a sock aficionado, and we usually give him a gift of some fun or funny socks at our yearly event. This year, we decided to collect socks and donate them in Matthew’s name to Beautiful Soles for local kids in need. I am happy to report we collected 523 pairs of socks and $125 amongst our brokers.

Thank you to everyone who gave to our Healthcare Worker Meal Drive in December! We raised $4,360 which enabled us to deliver meals and snacks to frontline workers at Providence in Everett, Swedish Edmonds, and UW Medicine Northwest Hospital. We partnered with We Got This Seattle, who helped us coordinate the restaurants we ordered from and set up our contacts at the hospitals. I am so grateful for ALL of our local frontline workers who have been working so long and hard under the most difficult circumstances.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link