|

|

|

|

I’ve said it before and I’ll say it again, the 2021 real estate market has been a head-turner! In the second half of 2020, once we started to emerge from the COVID lockdown, the real estate market started to bustle with activity. 2020 ended up being a robust real estate year driven by low interest rates and many COVID-influenced moves due to remote working and retirement. Who would have thought a global pandemic would have such a profound effect on the demand for real estate? Many people decided to retire and exit the state, many people entered our state and exited another, and a large portion of buyers who were no longer anchored by their commute followed their hearts to the suburbs and more rural locations.

When the calendar turned to 2021 the real estate market exploded! Inventory was depleted as 2020 did not provide the normal amount of new listings in tandem with a jump in demand. This combination created price escalations in 2021 that were beyond our wildest imagination. The price points for neighborhoods were re-established almost overnight with benchmark sales elevating the value proposition for the communities in which we live.

Seasonality has always had an effect on the market even in 2021. The first quarter of the year typically has the lowest amount of new listings as sellers make their way out of the short, dark days with soggy yards and projects on their to-do lists to prepare their properties for the spring market. The homes that sold in Q1 2021 saw above-normal gains over the list price. In fact, in Snohomish County, the average list-to-sale price ratio in March was 108%, and in King County 106%. As I mentioned earlier, almost overnight price appreciation established new home values for our communities.

Once the seasonal spring listings started to show themselves and buyers had additional selection, the price gains actually increased! The classic law of supply and demand relates the amount of supply against the amount of demand, and in turn provides a value. In the case of the 2021 spring market, the increase in supply actually was not enough to meet demand and put upward pressure on prices. Recorded sales from March to June saw the highest list-to-sale price ratios peaking at 110% on average in April in Snohomish County and at 108% in May in King County.

Since January the median price in Snohomish County has increased by 16% and in King County by 17%. Prices peaked in Snohomish County in June with the median price at $700,000 and in July in King County at $875,000. In August, both counties recorded prices 2% off the peak but were still sitting on top of a heap of price growth since the first of the year. Historically, markets will peak in the late spring, early summer as the ceiling of pricing starts to find itself. That appears to be where we are at. Although the figures this year have been intense and well above the norm, it is comforting to see typical seasonality still happening.

There is also this illusion that this type of market environment is easy. Yes, sales happen quickly and demand is high. I would be a fool to say that a sign in the yard and a feature on the internet couldn’t likely get a home sold. I must point out though that this market is nuanced and that obtaining the best results (top dollar and a smooth process) depends on how well all the steps are taken to prepare a property, price-position a property, and how carefully the negotiations and multiple offers are handled along the way by the broker. My office, Windermere North has continued to outperform the market in 2021 with shorter days on market and a higher list-to-sale price ratio than the market average. Check out our YTD comparison to the market averages to help understand how this elevated level of service makes a tangible difference for our clients.

As we head into fall and start to round out 2021, new homes that are coming to market are standing on the shoulders of the sales that took place earlier this year which created these increased home value levels. List-to-sale price ratios are starting to decrease as sellers are stair-stepping their pricing based on the freshly recorded home sales and the market is finding its peak for the year. Sellers that expect to stair-step and to escalate like homes did earlier in the year may find themselves disappointed and overpriced.

We are starting to see market times increase and expect a small surge in fall listings to help satisfy the buyer demand that remains. Low interest rates continue to provide buyers the flexibility to make moves with minimal debt service. As long as rates remain low, demand will continue. The good news is, not every home sale is a multiple-offer frenzy like we saw at the beginning of 2021. The new normal has established itself and buyers are becoming more savvy navigating this market. In my next newsletter, I will outline some expert buyer tools that have helped buyers succeed in this market.

The remainder of 2021 should complete a banner year in real estate. Sellers have made amazing returns and buyers are obtaining homes that better match their lifestyle goals with low debt service. COVID shook up how we value where we live. Remote work increased the value of our suburbs, retirees pushed prices in rural locations, and people having more time to reflect, shifted how they prioritize their homes’ features. Some folks even “got out” of Washington, but it wasn’t a mass exodus, as just as many are leaving other states for ours.

I see this last year and a half as a re-organization of our communities through housing, which comes with some positives and some negatives. Change can be uncomfortable, but change is certain. 2021 has been a year unlike any other! Seasonality, research, and relationships have been the stable markers that have helped me help my clients find success in this new environment and have helped me navigate some occasional choppy waters along the way. It is always my goal to help keep my clients well informed and empower strong decisions. Please reach out if you’d like to learn more about how the current market relates to your goals. If you know of anyone who needs real estate help, I would be honored to help take care of them as well.

All of us at Windermere Real Estate are proud to kick off another season as the “Official Real Estate Company of the Seattle Seahawks.” Since 2016, we’ve partnered with the Seahawks to #TackleHomelessness by donating $100 for every Seahawks defensive tackle made in a home game. And for the third season in a row, the money raised will go to Mary’s Place, a non-profit organization dedicated to supporting homeless families in the greater Seattle area. Mary’s Place works to provide safe and inclusive shelter and services that support women, children, and families through their journey out of homelessness.

Mary’s Place’s mission and the work of the Windermere Foundation go hand-in hand. On Sunday, we were able to donate $6,300, which brought our #TackleHomelessness total to $166,600 adding to our donations over the past five seasons. We look forward to raising even more this year!

Go Hawks!

|

||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||

|

At Windermere, we are fortunate to have Matthew Gardner as our Chief Economist. In fact, we are one of the only real estate companies in the country to have such a well-respected expert sitting in this role. Not only is Matthew an asset to Windermere brokers and their clients, but he is a coveted resource within the industry. He is often called upon by major media outlets and industry think tanks for his insights.

Every quarter Matthew produces The Gardner Report which re-caps various statistics and predictions for all of Western Washington. What is so great about this is you can read about where you live and also get a glimpse into other markets that may pique your interest.

Read the full Western Washington report here. Additionally, since Windermere spans the entire Western Region of the United States, he also provides this same report for Washington (Western, Central & Eastern), Oregon, Idaho, California (Southern & Northern), Utah, Colorado, Nevada, and Hawaii (Maui & the Big Island).

There has been a lot of state-to-state moves over the last few years. Many of these moves have been prompted by retirement, second home purchases, and remote working due to COVID changes to the workforce. This is a great way to research other markets you may be interested in. Also, I am connected to the Windermere network of brokers and can easily find you a reputable broker who would be a stellar match for your real estate needs outside of my normal market area.

Further, I am also a part of a national and international network of real estate companies for referrals outside of the Windermere footprint. This is through Windermere’s affiliation with Leading Real Estate Companies of the World. Bottom line, I can help provide information and can help align you with a trusted real estate advisor anywhere in the world. Please reach out of I can help!

Huge thanks to everyone who donated to my office’s Summer Food Drive! Collectively we provided 2,608 meals for our neighbors in need! We presented a check for $3,400 and 888 pounds of food to the Volunteers of America Western Washington food banks last week, and that’s all because of you! Thank you!

Food insecurity is one of the most prevalent social issues of our time. Volunteers of America food banks, food pantries, and distribution center all exist to tackle hunger in our community and also serve as touch-points to connect our neighbors with other basic needs.

My office is collecting donations for local food banks! You can donate directly to our GoFundMe or drop off donations at my office during the month of July. All donations will benefit The Volunteers of America Western Washington food banks. Let’s come together to help our neighbors in need!

The VOA works hard to ensure that nobody goes hungry, check out the video below for more information on the VOA and where your donations will be going!

|

|

|

|

|

|

|

|

On June 11th, my office spent our annual Windermere Community Service Day with the Snohomish Garden Club constructing trellises, weeding and staking beds, and planting and labeling a half-acre of produce! We also assembled a pole shed, built out a composting area and a rock bench on the property for the Garden Club to use throughout the year. The Snohomish Garden Club will harvest the half-acre, which will yield close to 10,000 pounds of fresh produce to be donated to local food banks in Snohomish County.

On June 11th, my office spent our annual Windermere Community Service Day with the Snohomish Garden Club constructing trellises, weeding and staking beds, and planting and labeling a half-acre of produce! We also assembled a pole shed, built out a composting area and a rock bench on the property for the Garden Club to use throughout the year. The Snohomish Garden Club will harvest the half-acre, which will yield close to 10,000 pounds of fresh produce to be donated to local food banks in Snohomish County.

My office is also conducting a Food Drive in the month of July via The Windermere Foundation, in tandem with this planting project with a goal to donate $5,000 to the Volunteers of America Food Banks across Snohomish County. You can donate to our GoFundMe, or drop off non-perishable donations at my office through the month of July.

For more information on these great organizations and how you can lend a hand, please visit:

Windermere’s Community Service Day was established in 1984 to offer agents and staff a chance to volunteer a workday to give back to the neighborhoods in which they live and work.

Here we are, one-third into 2021, and boy what a ride it has been so far. We all know that 2020 was a unique year full of challenges and change. The pandemic made us pause and reevaluate many aspects of our lives including where and how we live. The impact of the pandemic on the real estate market was significant, as people started to shift their housing priorities during the second half of 2020. Then the calendar turned to 2021 and the frenzy of all market frenzies began.

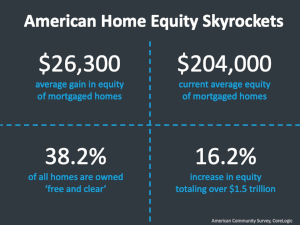

I had the misguided notion that closing out 2020 was going lead to more normalcy in our industry as we all yearned to move on to the new year. Boy, was I shocked as Q1 unfolded; 2021 had its own agenda in store! What the new year brought, was its own set of drama as the economy headed towards recovery and the vaccine emerged. The continued historically low interest rates have fueled the housing pivots being made across our region and our country. Lifestyle moves have driven demand, but interest rates along with hearty equity levels have helped financially enable these life-changing moves. Interest rates have hovered around 3% since the beginning of the year. Additionally, 38% of all homeowners own their homes free and clear, and over 50% of homeowners have up to 50% equity.

The work-from-home phenomenon (either permanent or hybrid) has re-shaped the housing market, driving many people to consider the suburbs or rural locations. Eliminating the daily commute into urban work centers has created flexibility for homeowners to live farther away from work and enjoy larger spaces and more affordable housing in comparison to cities like Seattle and Bellevue. In fact, the median home price in Snohomish County is up 15% complete year-over-year in comparison to King County at 10%. This is proof that suburban and rural housing is on the rise.

Demand (defined above) has helped to push price appreciation levels along with a shortage in available inventory. We have functioned in a lower-than-normal inventory market for over six years now. Zero to three months of inventory is defined as a seller’s market, three to six months a balanced market, and over six months a buyer’s market. This figure is established by estimating how long it would take to sell out of homes based on the closing or pending rate if no new homes came to market. In the second half of 2018, we eclipsed three months briefly but have mainly existed under three months for quite a while. In 2021, we have not breached one month, and in many submarkets have only had up to two weeks of available inventory.

2020 left a void of available inventory because we were in quarantine and many people were not comfortable opening their homes up to strangers. Plus, some people needed to pause and see how this was all going to shake out for them. I think the turn of the new year coupled with the vaccine has empowered people to make the moves they have been considering while they won the wait at home. We have a smattering of generations at the helm all wanting to make moves for different reasons. First-time home buyers, retirees, and move-up buyers are all hoping to take advantage of low debt service and pivot to a home with a better fit for their lifestyle goals.

Lifestyle demands, low rates, scarce inventory,  and formidable equity have created a very competitive market. Large down payments due to moving equity from one home to the next, along with strict lending requirements have propped up the stability of the housing market. I am often asked if we are headed towards a housing bubble because of the rate of home appreciation, but it is important to understand that home values are supported by strong loan-to-value ratios and scrutinized lending. Unlike the Great Recession of 2008, when predatory lending (that involved low to no down payments and undocumented loans) formed an unstable foundation that eventually crumbled.

and formidable equity have created a very competitive market. Large down payments due to moving equity from one home to the next, along with strict lending requirements have propped up the stability of the housing market. I am often asked if we are headed towards a housing bubble because of the rate of home appreciation, but it is important to understand that home values are supported by strong loan-to-value ratios and scrutinized lending. Unlike the Great Recession of 2008, when predatory lending (that involved low to no down payments and undocumented loans) formed an unstable foundation that eventually crumbled.

The biggest challenge I see in the housing market in our region is affordability. It is expensive to live in the Greater Seattle area, plain and simple. The work-from-home option has provided flexibility to live farther out, which has put upward pressure on prices everywhere. We have had a re-organization of where people live and it has been surprising which communities have become attractive and in-demand. I predict at some point this will settle down as these newly refined housing needs find their place. Additionally, May through August is when we seasonally see more homes come to market. This should hopefully make it a bit easier for buyers to secure a home, and help soften the ramp-up on prices. This has already started to show itself over the last few weeks.

Financial indicators in our region are positive. Only 3.6% of homes in Washington state are in mortgage forbearance (a fraction of where we were at a year ago), tech jobs continue to drive employment, and the overall local economy and home equity are very strong. Your home is intended to be a long-term investment. If price appreciation starts to soften as we climb out of our inventory deficit this will be more sustainable for affordability. Buyers will still be on the road to building wealth with some of the lowest interest rates ever, and we must remember that homeownership is not just an investment but where we live and create memories. Sellers will continue to enjoy large payoffs as long-term equity growth is abundant. Keeping a grounded perspective will be key as the market twists and turns from the extremes. If there is anything I can guarantee it is that the market is always changing and it can change fast.

If you are curious about how today’s market relates to your lifestyle and financial goals, please reach out. I’d love to discuss your needs, curiosities, and concerns as this has been an intense and eventful start to 2021. It is always my goal to help keep my clients informed and empower strong decisions.

June 11th is our annual Windermere Community Service Day; our office will be volunteering alongside the Snohomish Garden Club helping plant nearly an acre of fruits and vegetables that will be harvested for local food banks. This will be our 5th year working on this project that yields thousands of pounds of fresh produce for the food insecure across our region.

Windermere Community Service Day is a 40-year long tradition of giving back to the communities in which we serve, it is a valued part of our Windermere culture. If you would like to donate to help us provide additional veggie starts and supplies, please reach out. I will report back on our project in my next newsletter, letting the planting begin!

Matthew Gardner is the Chief Economist at Windermere and a sought-after expert on real estate, both locally and across the country. Every quarter, Matthew breaks down the real estate market by region and provides the Gardner Report; you can read this quarter’s full report here. Additionally, he also provides a monthly video report touching on the latest trends and hot topics concerning the real estate market. Click on the image below to view his latest Monday with Matthew video.

If you have any questions or curiosity about the current real estate market that you would like to discuss, please reach out. Are you curious about the value of your home, are you contemplating a move, or considering a new purchase? I can help! It is always my goal to help empower my clients to make strong financial decisions and to help them understand how real estate can positively affect their lifestyle.

Thank you to everyone who came through our shredding event this year! The results from the food drive were overwhelming. Through all of your generous giving, we collected 2,290 pounds of food and $7,080 in cash! Concern For Neighbors Food Bank were thrilled to pick up so much tangible love and help. They will use the funds to purchase food to provide to the community in need over the next several weeks.

If you’d like to donate, please visit their website (above) to see their COVID-19 schedule and how you can help.

Homeowners across our region are enjoying incredibly healthy equity levels due to an upswing in the real estate market over the last five years. In fact, the median price in King County is up 50% over the last five years and up 55% in Snohomish County. Over the last 10 years, the median price is up 96% in King County and 106% in Snohomish. This growth in equity has given homeowners the exciting option to sell their home for a high price and move on to their next chapter, such as a move-up, down-size, or second home. This price growth is great news and provides many opportunities; however, we have also faced some challenges in how to make these transitions due to tight inventory.

The biggest challenge for buyers, which is conversely a benefit for sellers in the marketplace right now, is limited inventory levels. Buyers who need to sell their homes first in order to buy want to benefit from the upward pressure on prices for their home sale but are fearful of finding their next home in a timely manner. Currently, King County sits at 0.6 months of inventory and 0.4 in Snohomish based on pending sales data. These levels create a multiple-offer environment that is tough for buyers whose down payment is not readily available. Historically, buyers that are also sellers (those who have their down payment tied up in the equity of their home) would commonly secure a new home contingent on the sale of their current home. Meaning the seller of the new home they are buying would give them a month or so to get their current house sold in order to buy theirs. In this market, that is only rarely an option- like unicorn status.

So, the million-dollar question is this: how does one who has gained so much equity, now itching to get that bigger house, more functional floorplan, different location, or perfect rambler for settling into retirement, make this transition? We need to get creative, have a strategy and be ready to take on some possible short-term discomfort for long-term gain. Three options that are proven to be successful are: negotiating a rent-back for my sellers, using the Windermere Bridge Loan program, or having the bold courage to sell first and possibly move twice.

1. RENT-BACK

First, negotiating a rent-back has become a great option for someone who needs to first sell their current home in order to buy. The way it works is we put their home on the market, price it competitively to create demand, and ask for a rent-back as one of the preferred terms. If this rent-back is successfully negotiated, then the seller closes on their home and collects their funds but gets to stay in the house anywhere from 30-60 days post-closing. This enables the seller, who is now a buyer, to have their cash-in-hand, time to find a new house, get it under contract, and close the sale when their rent-back is ending. This eliminates the need to move twice. There is a bit of calculated risk in this plan, but I’ve seen it work several times, always with a plan B (interim place to move) ready just in case. Rarely has plan B needed to be executed, and often we’ve even been able to negotiate under market rent rates during the rental period.

2. WINDERMERE BRIDGE LOAN

The second option is the Windermere Bridge Loan program. This is an amazing tool for homeowners that own their homes free and clear, or who have sizable equity. This is an efficient, low-cost option where a buyer who needs to sell can pull the equity out of their house prior to selling it in order to make a non-contingent offer. The way it works is we establish the market value of the house the homeowner currently owns, via comparative market analysis (CMA) that I complete and is signed off by my managing broker. We then take 75% of the CMA value and subtract any debt owed, and that is the maximum amount the homeowner can borrow for their next down payment (max limit $1M).

They can then make a non-contingent offer on a new home as long as their lender approves that they can hold the current home and qualify for the new mortgage at the same time. What is really great about this program, is that it doesn’t require an appraisal (like a HELOC does), and these can easily be turned around in 5-7 business days. This tool provides the opportunity to quickly and inexpensively utilize your equity, be competitive to win the next house, and eliminates the double move.

The fees associated with this program are a 1% loan fee on the equity that is pulled, a title report, and interest that is incurred between the loan funding and being paid off once the subject home is sold. That interest is conveniently wrapped up in the closing costs when they close the sale of their home, eliminating the need to make monthly interest payments. In a strategy that is somewhat mind-blowing- we can sometimes use these bridge loans and never have to actually fund them. For example, if we secure a property non-contingent with the bridge loan and immediately get the bridge loan home on the market, we can often secure a sale with a simultaneous closing, and never have to fund the loan. This eliminates the loan fee, interest, and the need to carry two mortgages.

3. SELL FIRST, MOVE TWICE

The third option is to tie up your bootstraps and get your home sold before you start actively shopping for the next. By all means, study the market, get pre-approved and have an idea of where and what you want, but remain committed to selling your home first. The benefits of selling your home first are being up against less competition and knowing exactly how much money you have to work with in the end.

Typically, we see more inventory come to market in Q2 and Q3, the earlier in the year a home comes to market the less competition they experience which is always favorable for the seller’s financial outcome. Knowing exactly how much you are going to net from your home sale is an empowered position to be in as is having the cash in the bank when vying for your next home. In this market, we are seeing shocking price escalations and this “extra” cash could be the difference-maker to obtain your dream home.

It does take bold courage to sell your home first as it often requires a double move. I know, that sounds miserable, moving is hard and disruptive. What is also costly and miserable is spinning your wheels as a buyer as prices appreciate and missing out on opportunities. The advent of VRBO and AirBnB has created a much more available short-term rental market and can provide an interim place to land while you shop for your next home. Some folks have friends and family that will take them in, it’s all in the name of getting creative. Having your cash in hand will make you more competitive and you will have a clear financial picture. Most things in life that are meaningful are hard. If it was easy, everyone would do it. Be bold, be courageous! Short-term discomfort for long-term gain is the focus with this strategy and after 2020 our resilience muscle seems to be a bit stronger, making this option more viable.

If you are excited about the equity you have grown and want to pair it with today’s low interest rates to obtain your next home, but have been fearful of how to do it all – I can help! These three options, along with great attention to detail, hand-holding, and careful planning have helped many people make these exciting transitions. It is my goal to help keep my clients informed and empower strong decisions. Please contact me if you would like further information on how this might work for you or someone you know.

4211 Alderwood Mall Blvd, Lynnwood

We are partnering with Confidential Data Disposal for our 10th year; providing you with a safe, eco-friendly way to reduce your paper trail and help prevent identity theft.

Bring your sensitive documents to be professionally destroyed on-site. Limit 10 file boxes per visitor.

We will also be collecting donations to benefit Concern for Neighbors food bank. Donations are not required, but are appreciated.

Hope to see you there!

**This is a Paper-Only event. No x-rays, electronics, recyclables, or any other materials.

The 2021 real estate market is off to a very brisk start. Historically low interest rates are driving buyer demand. This is coupled with a needed “catch-up” in available homes for sale. In 2020, we saw a stall in new listings during our normally plentiful spring market due to the pandemic. From April to June of 2020, new listings were only a portion of what would have been typical for that time of year. Where it became tricky was in May of 2020 when buyer activity rebounded, and we started to record higher levels of pending sales in 2020 over 2019. This led to the inventory deficit that we currently find ourselves in.

The stats above for King and Snohomish counties highlight the January statistics. In both markets, prices are up year-over-year and well above average appreciation levels. This is due to the phenomenon described above which is a classic case of supply and demand. This has led to months of inventory remaining tight, with mere weeks’ worth of available homes. Days on market have reduced by 38% in King County and 41% in Snohomish County year-over-year, and homes are consistently selling at or above list price.

What does this market mean for sellers? We have already seen sellers that have come to market in Q1 enjoying large buyer audiences and great results. Note that the stats in the image are closed sales in January, which means most of them went under contract (pending) in December. Transactions that closed over the last 7 days and most likely went pending after the first of the year are recording very favorable results for sellers. For example, in King County, there were 305 closed sales from 2/9/21 to 2/15/21 with average days on market at 24 days and a 108% list-to-sale price ratio. In Snohomish County, there were 101 closings in the same timeframe, with average days on market at 14 days and a 104% list-to-sale price ratio. Tight inventory and motivated buyers are creating these results. As we head into spring, we expect to see more homes come to market which could soften these escalations. This would not be a bad thing as sellers are sitting on 9 years of equity growth and these recent gains have been a bonus.

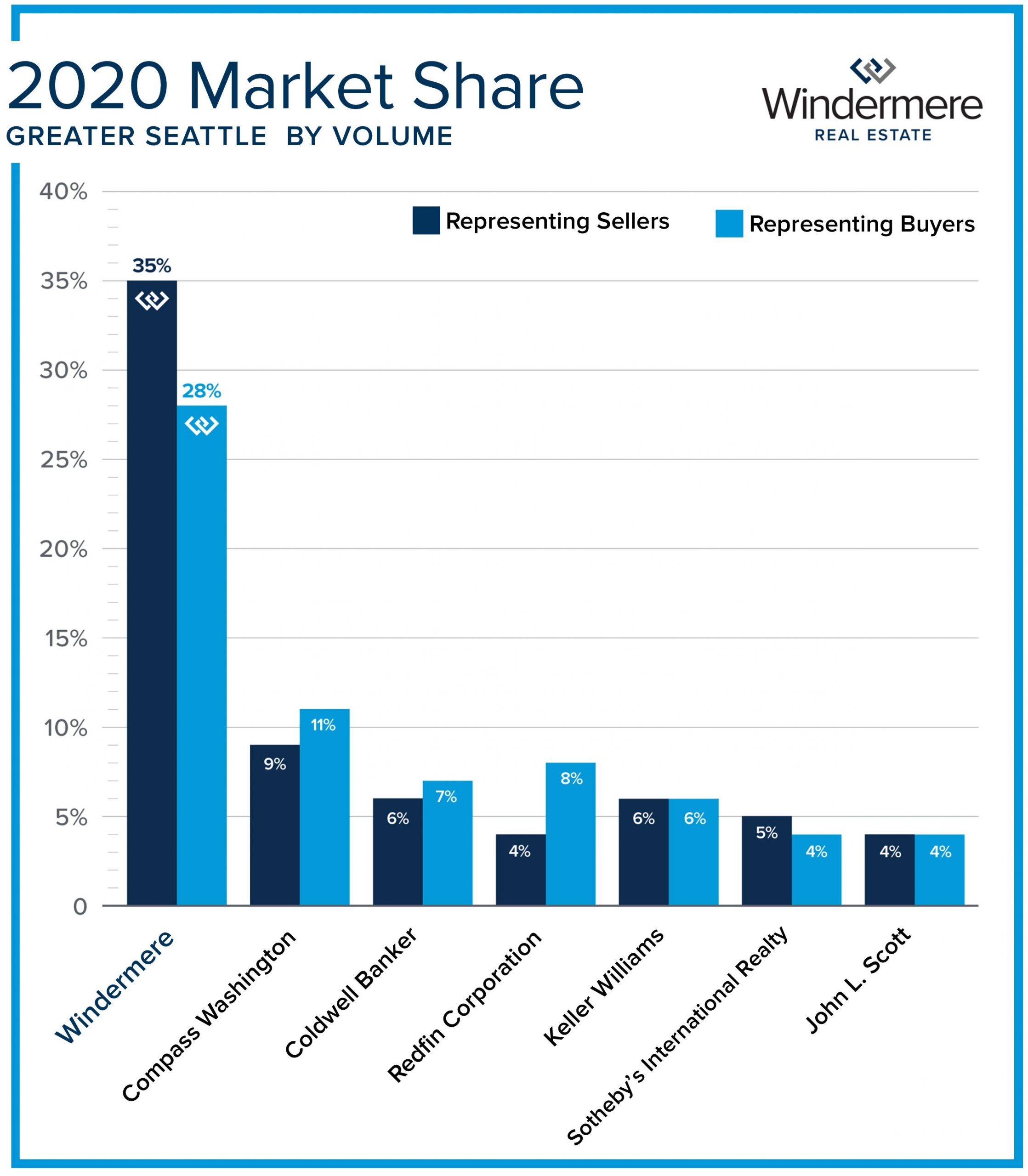

What does this market mean for buyers? Well, you must have a plan! Pre-underwritten financing, pre-offer performed due diligence, organized funds for the down payment, and possible appraisal cushions have been key elements for success. In addition, aligning with a skilled broker to help a buyer prevail is paramount. A responsive broker who is a good communicator can be the difference-maker in winning a home. Listing agents and sellers will not only vet the elements of an offer, but they will also consider the working relationship established with buyers’ brokers as they review offers. There is a special magic to developing these relationships and it takes extra effort. Windermere as a company has been a market leader for many years and continues to work hard to make strong connections for success.

Buyers are anxious to secure their next home with today’s interest rates helping to off-set the expense of price appreciation. With debt service so low, buyers are hungry for more inventory and will most likely start to see an increase in selection in the spring and summer months. Fortitude is the name of the game for buyers, but it will be worth it in the end as the interest rates are amazing and price gains don’t seem to be going away anytime soon.

If you are curious about how today’s market relates to your real estate goals or know someone that needs real estate assistance, please reach out. I am constantly studying the activity in the market to anticipate where we are headed in order to provide sound guidance. It is always my goal to help keep my clients informed and empower strong decisions.

At Windermere, we help people buy and sell homes, but we also help build community. I’m proud to support the Windermere Foundation which has raised over $43 million in the past 32 years for low-income and homeless families right here in our local community.

In 2020, the Windermere Foundation provided over $2.5M in funds to 569 organizations, while keeping administrative expenses to 2%. The Foundation has been dedicated to helping homeless and low-income families and individuals since 1989. A portion of every commission is donated to this effort along with funds raised from special projects in individual offices.

In 2020, my office donated 5,600 lbs of food and $24K to various food banks associated with The Volunteers of America of Snohomish County as a result of four separate food drives we held throughout the year. We partnered with the YMCA’s Camps Orkila and Colman and donated just over $9K in order to keep the camp operating even though they were not able to open due to the pandemic. This will ensure they will be ready to have kids enjoy the benefits of camp when it is safe. We also sponsored 24 teenage foster boys at Christmas and made sure they had gifts on Christmas morning. We aligned with Pioneer Human Services to create this connection as well as provided grocery gift cards totaling over $3K to eleven families so they could enjoy well-stocked cupboards during the holidays. These opportunities to give back bring purpose to our work and we will continue to work with these organizations in 2021.